Previously I’ve written a post explaining the benefits of using Revolut over a traditional bank. Well not anymore. This time i will be writing why i’ve decided not to use Revolut anymore - simply because it will not be worth it anymore.

Aside from the annoying emails wanting you to upload a new ID document and photo every couple of months, the only other information i am subscribed to receive from Revolut is their policy updates. This is how their last email looks like:

Hey

, We’ve been talking with thousands of you about how we can help you get even more from your money.

We know you’re looking for easier ways to manage your spending everyday, not just when you’re abroad, and that saving a little money is always nice, too. So, we’re launching a brilliant new app to help you spend, save and invest with us, releasing new Rewards that bring you cashback and discounts from top brands, and working on lots more still to come!

As we invest in new benefits to bring you value everyday, we’ve taken a look at all of our features and made a few changes, mostly to the ones that aren’t used very often. This has meant a few updates to our terms and conditions, which you should know about.

The key changes are:

- To give you more peace of mind, we’re adding more detail in our terms about how we “safeguard” your money.

- You know that sinking feeling you get when you pay someone and moments later realise you put the wrong account details in? We’re addressing this by introducing an ability for our support teams to reverse some mistaken payments made into Revolut accounts.

- As you probably know, if you exchange more than our free exchange limit in a month, you pay a fee. This limit is decreasing to 2000 BGN each month (which, our research shows, most of you won’t hit anyway). Above that limit, our fee will stay the same at just 0.5%, and we’ll let you know if an exchange will be subject to a fee. Our Premium and Metal plans still have unlimited exchange, as they always have.

- You will continue to enjoy the same interbank exchange rates on weekdays. For exchanges at the weekend, we’re slightly increasing our mark-up for major currencies from 0.5% to 1%, to cover our risks when the market moves (as it has a bit recently). The mark-up for other currencies is staying the same – see the full list here. (Remember, you can avoid this fee completely by making an exchange on weekdays.)

- Our most popular payment types, such as payments to Revolut users, domestic transfers and Euro transfers within the Single Euro Payments Area are remaining free. If you make any other transfer to an account outside of your country, your first payment each month is also remaining free, but after that there will be a fee of 1 BGN per payment.

- If you make a transfer to a country that is not in its national currency, there will be a fee of 6 BGN for USD transfers (like US Dollars to Brazil) or 10 BGN for non-USD transfers (like GB Pounds to Brazil.) We’ll always let you know beforehand if a transfer you are about to make will incur a fee.

We’ve also made some other changes to make things simpler. You can find out all the details in our updated terms and conditions**.**These changes will take effect on August 12, 2020. If we don’t hear from you before then, they will apply automatically. If you want to close your account because of them, you can do that without charge, but we’ll be sad to see you go.If you have any questions, you can read our FAQ or contact our in-app customer support team.If you need more from your Revolut account, then take a look at our Premium and Metal plans, which offer unlimited FX and even more features, including Junior accounts, commission-free trading and more. You can upgrade by clicking here.

Thanks for being part of Revolut!

So, what’s the problem here? They are a for-profit organization and want to make money, right?

Yes, but they are degrading their service to do it. Let’s go through the changes one by one.

As you probably know, if you exchange more than our free exchange limit in a month, you pay a fee. This limit is decreasing to 2000 BGN (1000 EUR) each month (which, our research shows, most of you won’t hit anyway). Above that limit, our fee will stay the same at just 0.5%, and we’ll let you know if an exchange will be subject to a fee. Our Premium and Metal plans still have unlimited exchange, as they always have.

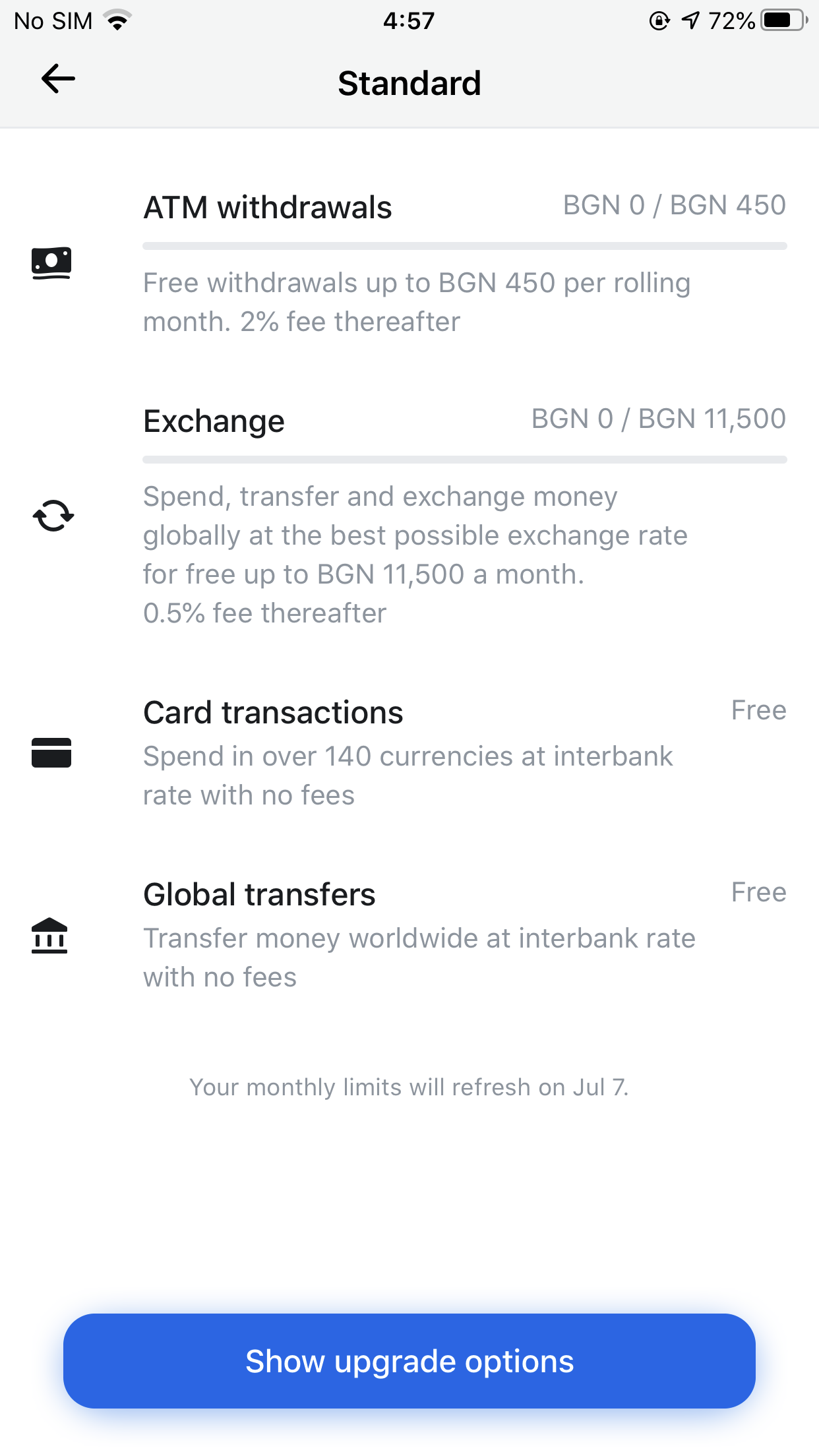

They are actually decreasing the limits 5 times. Until now the limit was 11500 BGN (5000 EUR). If no one hits them, why even bother decreasing them? What data did their research include? Did they count the accounts that people created and don’t use or only active accounts? Obviously the old limits were high enough so most people stayed under them, but the new ones are too low, even for my home country - Bulgaria. With the introduction of the new limits, a lot of the freedom that Revolut provided will be taken away. I have to note here, that even the banks that i use, don’t have fees for exchanging money using their online solutions. This way Revolut are forcing everyone to upgrade to their paid plans, even if they didn’t need it before.

Old Revolut limits

Okay then, they have limits and take fees above those limits, but hey at least they offer a great exchange rate, right? Well, not exactly. Here comes the second change:

You will continue to enjoy the same interbank exchange rates on weekdays. For exchanges at the weekend, we’re slightly increasing our mark-up for major currencies from 0.5% to 1%, to cover our risks when the market moves (as it has a bit recently). The mark-up for other currencies is staying the same – see the full list here. (Remember, you can avoid this fee completely by making an exchange on weekdays.)

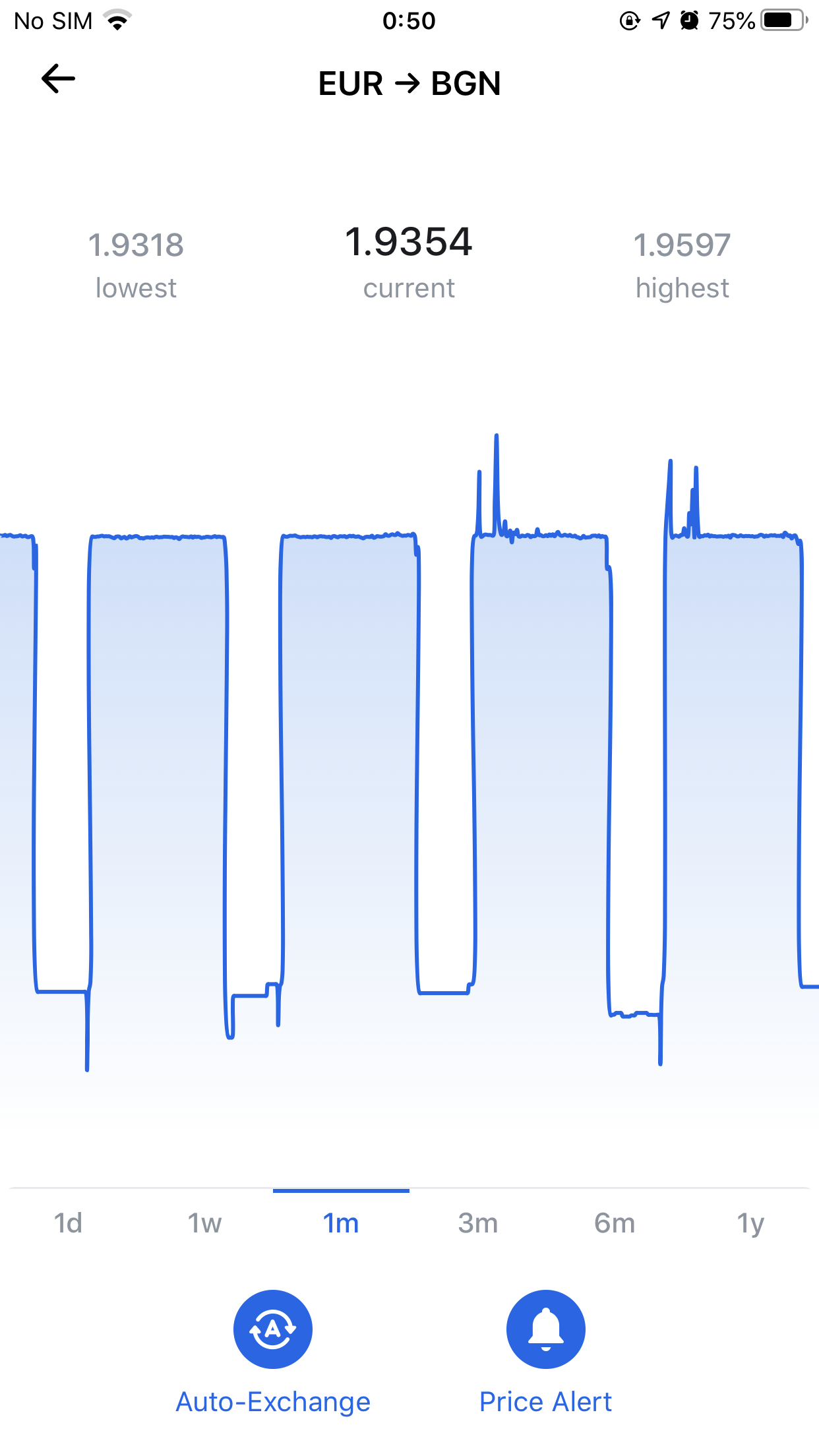

Their exchange rates on the weekends weren’t exactly great from the beginning. Let’s take the exchange between EUR and BGN for example. I am using that combination as it’s relatively fixed and usually shouldn’t vary more than 0.01 in any direction. You can Google the history and you’ll see what i’m talking about.

Below is an image of the history, of the exchange rate between EUR and BGN in Revolut.

EUR - BGN exchange rates in Revolut

As you may notice, there are periodic drops in the rates - these happen every weekend. Not only that, but the drops are quite big - 0.03. Since the weekends are time to spend your money, if you need to do an exchange, you’ll be at a disadvantage. The example shows BGN and EUR, but this happens across all currency pairs. Even the banks that i use don’t do this. It’s better to use alternatives, if you’re going to exchange more than just a small amount of your currency.

As a comparison, the current exchange rate at Transferwise is 1.956 compared to 1.931 in Revolut. Even with their fee of 9 EUR, it’s better to use Transferwise, if you’re going to exchange more than 500 EUR. For 1000 EUR, the fees and the amount lost from the exchange rates of Revolut will be more than 25 EUR!

Our most popular payment types, such as payments to Revolut users, domestic transfers and Euro transfers within the Single Euro Payments Area are remaining free. If you make any other transfer to an account outside of your country, your first payment each month is also remaining free, but after that there will be a fee of 1 BGN per payment.

This one is pretty self explanatory - previously all transfers in all currencies were free, now there will be a fee of 1 BGN (0.5 EUR). However they do not say anything about register payments using their VISA/Mastercard in stores, so i count them as falling under the “other” transfer type. In this way my home bank wins, since payments with card are free, anywhere in the world.

If you make a transfer to a country that is not in its national currency, there will be a fee of 6 BGN for USD transfers (like US Dollars to Brazil) or 10 BGN for non-USD transfers (like GB Pounds to Brazil.) We’ll always let you know beforehand if a transfer you are about to make will incur a fee.

Again degradation of service - until now there were not such fees. While for normal users it’s unlikely to send a currency that is not the national currency, it’s quite inconvenient and there are cheaper alternatives - even PayPal. With PayPal, one would pay 2 (~3.4 BGN) USD for a card transfer in USD. However, if you want to send money in the national currency, it is still better to use Revolut than PayPal, as the latter has horrendous exchange rates.

Here’s a bonus rant about their cryptocurrency exchange.

Please don’t use it! Ever!

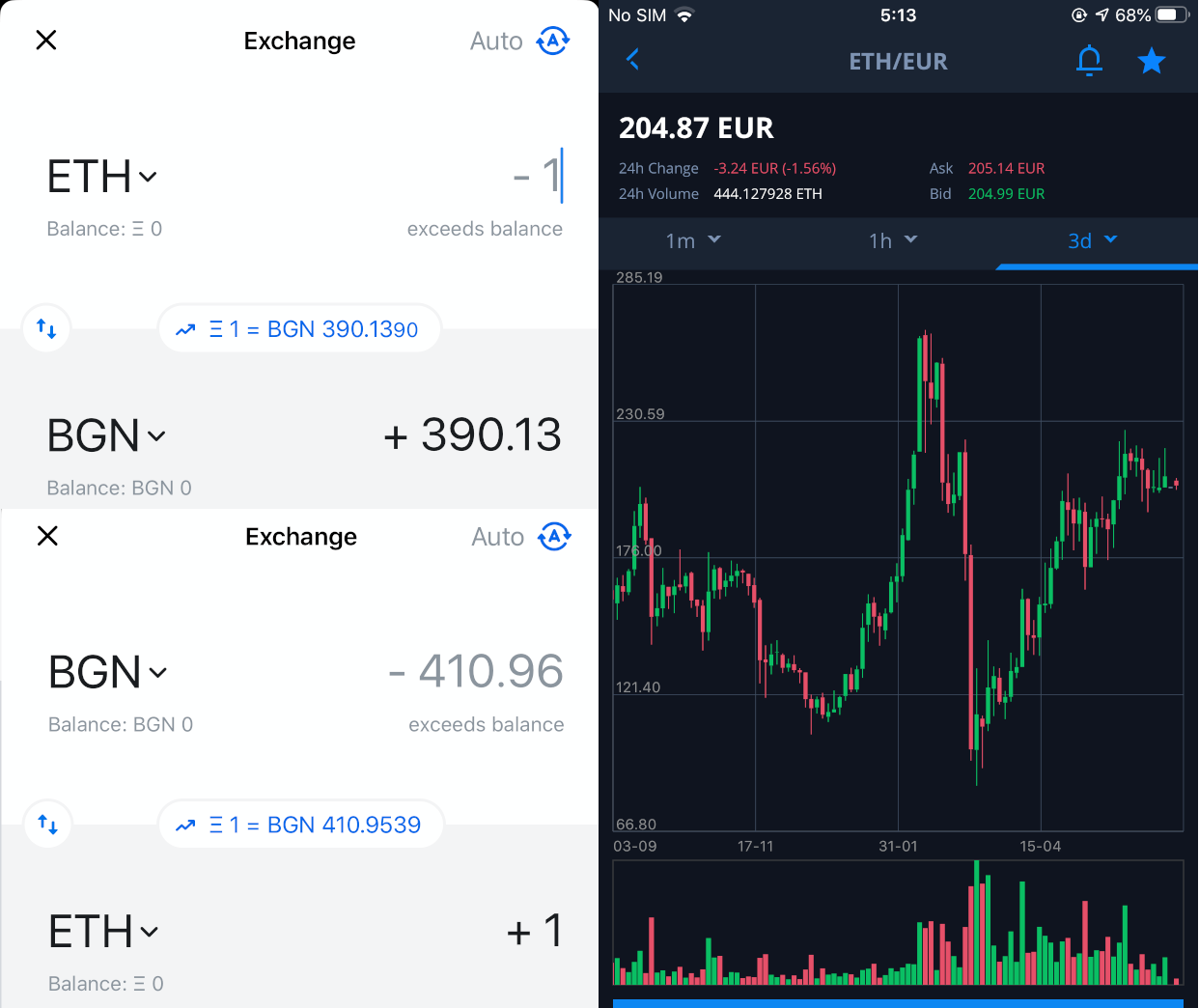

Aside from being absolutely closed to outside transfer for cryptocurrencies, they offer bad exchange rates. I will give an example with Ethereum.

On their exchange, they offer you 390 BGN (~195 EUR) for 1 Ethereum, while in fact ETH was well over 400 BGN (200 EUR). At the same time, if you want to buy ETH, they want 410 BGN (205 EUR). That’s a difference of 10 EUR! Look at the attached images for more information. At the same time, ETH was being traded at 204 EUR in real crypto exchanges. Don’t give Revolut your money in exchange for cryprocurrencies! They will just make huge profit from you.

That’s the end of my rant. I don’t think i will be using Revolut after the policy changes in August, since they will not be much different from my local bank.

We’ve been talking with thousands of you about how we can help you get even more from your money.

We want to help ourselves to even more of your money!

Don’t get me wrong - i am not trying to say they shouldn’t make profit. Revolut are trying to make it sound like these changes are to help us - the users, while it’s nothing like that.

Comments